According to a Vanguard Research Survey in 2017, of the three “types” of trust, Emotional, Ethical and Functional, clients chose emotional and ethical as far more important than functional when it comes to choosing a financial advisor. What this means is that 83% of Trust Factors had nothing to do with your credibility and everything to do with your client’s perception of your trustworthiness and how much you cared about and protected their best interest. Why is this important for financial institutions to understand?

Clients are Banking on Trust

Testimonials

Finally, a sales methodology that dismantles all of the “slimy” sales gimmicks of old and addresses the heart and science of a purposeful and successful sales conversation”

Tommy S.

Director, American Express

On behalf of the team, we thoroughly enjoyed the virtual training session and your engaging facilitation today.

Steve L.

V.P., Commercial Acquisition Group

Less Features. More Feel.

According to Financial Advisors Magazine; who surveyed over 1400 investors, communication breakdown, poor communication in general, and failure to understand the client’s needs were the top 3 reasons clients left advisors. All 3 are directly connected to the poor execution of the most important event in an advisor’s day…the moment of impact…the “Client Conversation.” Most advisors today have never been taught the neuroscience behind the Biology, Psychology, and Physiology of the human brain as it relates to trust and decision making. Therefore, they communicate the wrong information at the wrong time and in the wrong order.

Imagine if you and your team were able to learn the science of decision-making so when those conversations and closing opportunities arise, you know exactly how to direct the conversation to close at a much higher percentage. This is accomplished by understanding how to steer the conversation during key “moments of impact”

The good news?

That's where we come in.

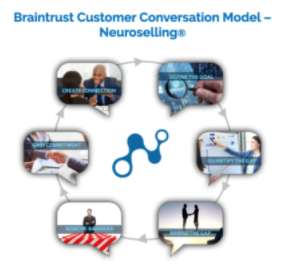

Braintrust has worked with 1000’s of financial advisors over the last decade. During our NeuroSelling® Program, we begin by interviewing select members of your team and even external customers/clients. We then custom build the “Customer Wheel” based on the personas we identify and then come together with you and your leadership team inside our NeuroMessaging™ session to make sure everyone is in agreement and alignment.

Our Sales Enablement Programs For Financial Institutions

It's about moving from 'Selling' to Serving-by-Solving

Phase 1: NeuroMessaging

Get Inside The Mind Of Your Customer

Nothing is more important than getting the message right. This session brings your key stakeholders together to learn the Braintrust methodology and then roll up your sleeves to create all the necessary insights based narratives that will help drive the organizational storytelling from marketing & prospecting to the customer conversation with the sales team.

Phase 2: NeuroSelling

Master The Customer Conversation

In an exclusive and intimate group setting, you will get hands-on training and coaching from the Braintrust experts. Over the course of the training, you will learn how the power of neuroscience and visual storytelling techniques can completely change your selling approach and drastically improve your customer relationships (and sales results!)

Phase 3: NeuroCoaching

Repetition and Reinforcement Drives Long Term Results

A program, process or methodology is only as good as the team’s ability to execute. In order to do that, people need good coaching. In this program, you will learn a coaching process that mirrors the “neuroscience” approach used in the customer conversation. Your coaches will get hands-on training and coaching themselves from the Braintrust experts. You will learn how the power of neuroscience and visual storytelling techniques can completely change how to give feedback, do 1:1 sessions (including ride alongs) and become a more motivational leader to your team

Let's Talk

We specialize in making those who partner with us look very smart, whether that’s to the board or your business colleagues. Speaking of that, smart growth shouldn’t cost $35,000/month. An engagement with us is on an ongoing monthly basis and can range from $2,000 to $6,000/month. From strategy to ongoing execution, we’re there every step of the way.

We guarantee an ROI on our annual engagements and only work with 30 companies at any given time.

If you’re interested in what you could expect each month, fill out the form below, and in the message, say “send the sample,” and we’ll send you what our $5,750/month engagement looks like.